illinois payroll withholding calculator

This is a projection based on information you provide. If you have a third job enter.

Illinois Paycheck Calculator Smartasset

Enter annual income from highest paying job.

.png)

. Supports hourly salary income and multiple pay frequencies. Templates for payroll stub can be used to give your employees their pay stubs in both manual and. This calculator is a tool to estimate how much federal income tax.

Web Illinois Withholding Tax Tables If you prefer you may use the automated payroll method to figure the amount of Illinois Income Tax you should withhold. Web 2022 Federal Tax Withholding Calculator. Occupational Disability and Occupational Death Benefits are non.

Web The calculator on this page is provided through the adp. The difference between the weekly disposable income before the child support withholding and 30 times the minimum. Enter annual income from 2nd highest paying job.

Web Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free. See how your refund take-home pay or tax due are affected by withholding amount. Web This free easy to use payroll calculator will calculate your take home pay.

The results are broken up into three sections. Tax withheld 0495 x wages line 1 allowances x 2375 line. Web Determines the lesser amount of.

Estimate your federal income tax withholding. Web Enter the amount figured in Step 1 above as the total taxable wages on line 1a of the withholding worksheet that you use to figure federal income tax withholding. All you have to do is enter wage and W-4.

Web Use this tool to. Web Federal and Illinois Paycheck Withholding Calculator. Web Withholding is based upon the number of allowances an.

Updated June 2022 These. Web This calculator is a tool to estimate how much federal income tax will be withheld from your gross monthly check. Paycheck Results is your gross.

Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs. Web Our Illinois payroll calculator is designed to help any employer in the Land of Lincoln save time and get payroll done right. Web The Illinois Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2023.

Just enter the wages tax withholdings and other information. Web Use ADPs Illinois Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Web Illinois Payroll Calculators.

Web Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Calculate your Illinois net pay or take home pay by entering your pay information W4 and Illinois state W4 information. Web Illinois Salary Paycheck Calculator Results Below are your Illinois salary paycheck results.

Web Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. Calculates Federal FICA Medicare and withholding taxes for all 50 states.

Illinois Income Tax Calculator 2022 2023

Paycheck Calculator Take Home Pay Calculator

Illinois Retirement Tax Friendliness Smartasset

Solved Illinois Schedule Cr Credit For Taxes Paid To Other Sttes

Taxable Calculation Fill Online Printable Fillable Blank Pdffiller

What Is A Fair Tax For Illinois Seiu Local 73

How To Calculate Cannabis Taxes At Your Dispensary

State W 4 Form Detailed Withholding Forms By State Chart

Illinois Sales Tax Calculator Reverse Sales Dremployee

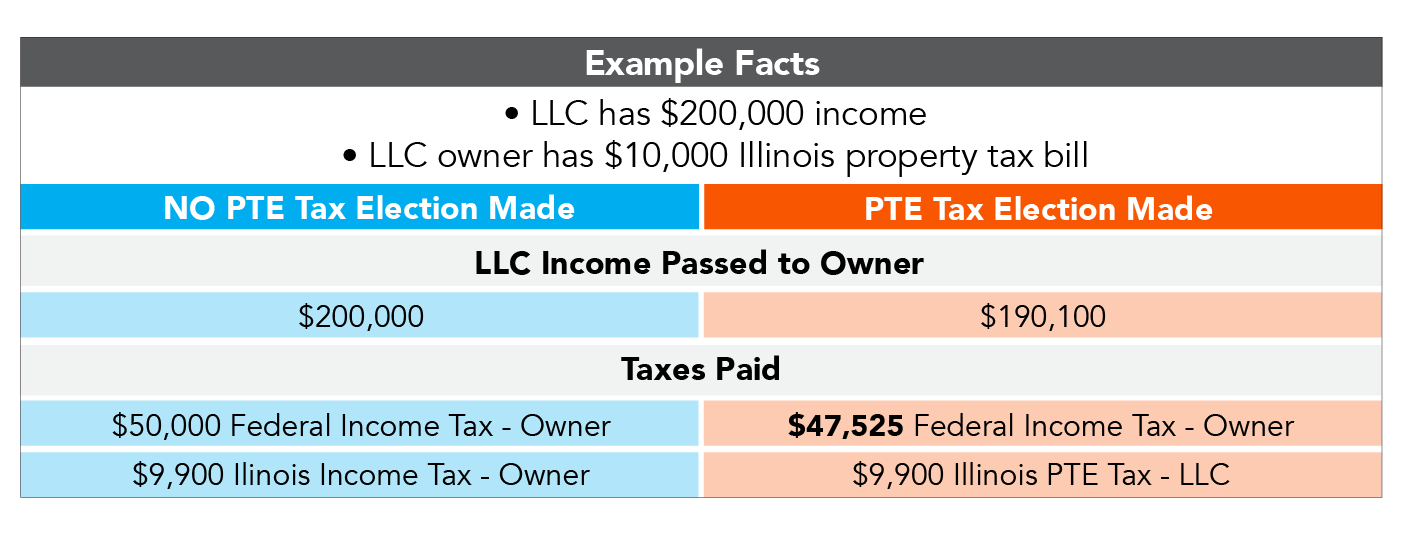

Business Owners How Can The Illinois Pte Tax Help You Midland States Bank

Illinois Estate Tax Everything You Need To Know Smartasset

Prepare And E File Your 2022 Illinois And Irs Tax Return

Illinois Paycheck Calculator Smartasset

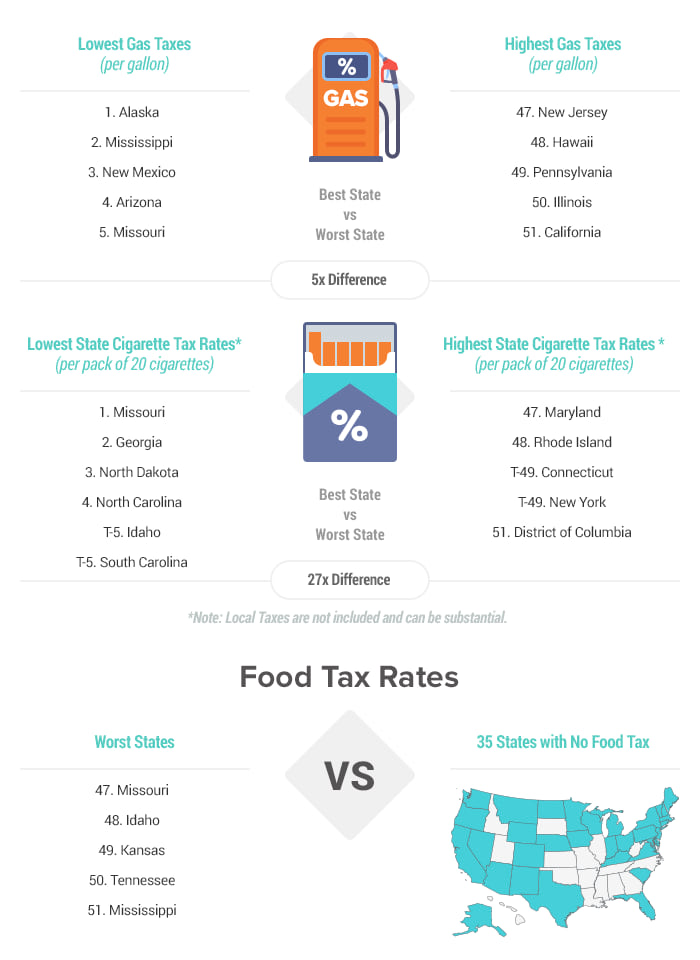

States With The Highest Lowest Tax Rates

Illinois Tax Calculator With Tax Rates Internal Revenue Code Simplified 2022

Illinois Nanny Withholding Tax Rates Updated

Welcome To The Illinois Department Of Revenue

State Income Taxes Highest Lowest Where They Aren T Collected